Iran"s metals export market underwent a notable contraction in 2022, with a decrease from $11. 57 billion in 2021 to $10. 82 billion, highlighting a market in transition. This decline, a 6. 8% reduction, reflects broader economic challenges and shifting global demand dynamics. Despite this contraction, the export of ores and metals from Iran saw a 12. 8% increase, underscoring an opportunity for targeted growth within specific metal categories. A detailed examination of trade data reveals Iran"s reliance on metals as a significant component of its export portfolio, though complexities in global trade relations and economic sanctions pose ongoing challenges.

For instance, the metals import value also increased to $3. 19 billion in 2022, marking a 25. 2% rise, which indicates a growing domestic demand and consumption that could be leveraged by international partners seeking to export to Iran. Globally, Iran"s standing in the metals market remains competitive, particularly in the aluminum and steel sectors. These sectors present promising avenues for strategic partnerships and investments, especially given the country"s substantial reserves and processing capabilities. With global inflation and fluctuating prices, Iran"s metals market is positioned to adapt by optimizing export strategies and enhancing supply chain efficiency. In navigating these market dynamics, businesses might consider leveraging platforms like Aritral. com.

Aritral offers a suite of services designed to streamline international trade, such as Product Listing and AI-Powered Marketing, which can be invaluable for companies seeking to enhance their market presence and manage profiles effectively. Additionally, Aritral"s Direct Communication feature facilitates seamless interactions with global sales partners, crucial for overcoming trade barriers and maximizing growth potential in Iran"s metals sector. "

-

عبدي منذ 3 شهرًا

عبدي منذ 3 شهرًا إيران

نظير النحاس

إيران

نظير النحاس

نظير النحاس الروسي بوزن مرتفع بأفضل سعر، نقاء 99. 99التفاصيل

-

محمدرضا منذ 3 شهرًا

محمدرضا منذ 3 شهرًا إيران

ميس_ايسوتوب

إيران

ميس_ايسوتوب

مرحبًا، نحاس نظير بصفاء 99. 99%، تم إنتاجه في عام 2021، من روسيا، بوزن مرتفع. أنا ممثل مشتري مباشر في خدمتكم.التفاصيل

-

محمد حاج محمدحسینی منذ 3 شهرًا

محمد حاج محمدحسینی منذ 3 شهرًا إيران

جنين متحجر أو بيضة متحجرة

إيران

جنين متحجر أو بيضة متحجرة

جنين ينتمي إلى حيوان أو ربما طائر، حيث تكون الأوعية الدموية مرئية تمامًا، حتى شكل الكائن والمكان الذي تتصل فيه الأوعية الدموية بالحبل السري محدد بوضوح...التفاصيل

-

بهزاد منذ 4 شهرًا

بهزاد منذ 4 شهرًا إيران

نيزك

إيران

نيزك

لقد وجدت للتو نيزكًا جديدًاالتفاصيل

-

محمد جواد باقري منذ 4 شهرًا

محمد جواد باقري منذ 4 شهرًا إيران

الألمنيوم والحديد والصلب والمخللات والفواكه المجففة والبقالة والزعفران والتوابل ونفايات المعادن والذهب والقار ومنتجات الألبان والمربى والعسل والنحاس والفضة

إيران

الألمنيوم والحديد والصلب والمخللات والفواكه المجففة والبقالة والزعفران والتوابل ونفايات المعادن والذهب والقار ومنتجات الألبان والمربى والعسل والنحاس والفضة

أنا على اتصال مباشر مع جميع هؤلاء الموردين من إيرانالتفاصيل

-

تقی قاسم زاده منذ 2 شهرًا

تقی قاسم زاده منذ 2 شهرًا إيران

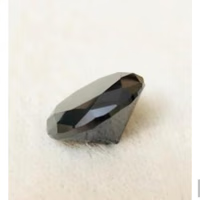

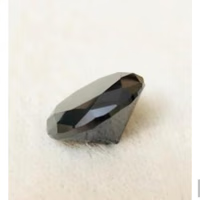

أحجار كريمة ونصف كريمة

إيران

أحجار كريمة ونصف كريمة

بيع خاص لياقوت أفغاني مستخرجالتفاصيل

-

حسن صادقي منذ 3 شهرًا

حسن صادقي منذ 3 شهرًا إيران

نظير النحاس

إيران

نظير النحاس

نظير النحاس المرخص للتصدير على شكل سبائك وزنها 5 كجمالتفاصيل

-

سامازاكري منذ 4 شهرًا

سامازاكري منذ 4 شهرًا إيران

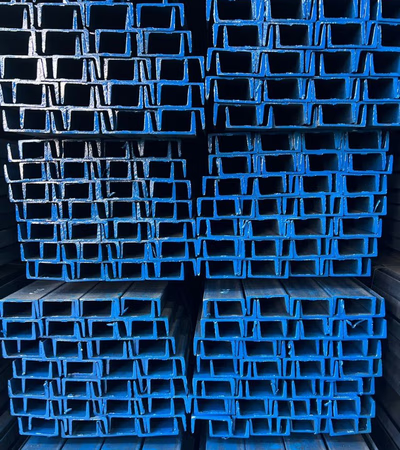

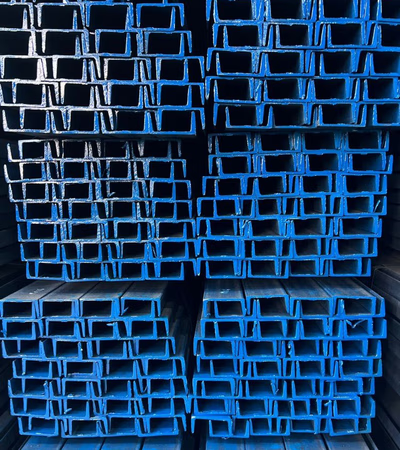

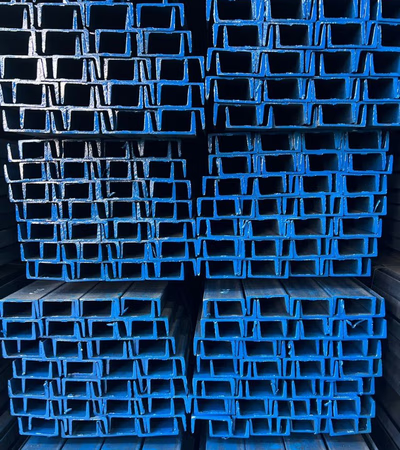

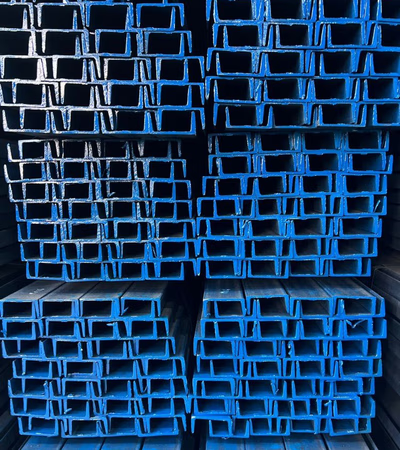

أي شيء تريده. . نحن ننتج زوايا وقنوات فولاذية ويمكننا تصدير هذه المنتجات

إيران

أي شيء تريده. . نحن ننتج زوايا وقنوات فولاذية ويمكننا تصدير هذه المنتجات

أي شيء تريده.التفاصيل

-

مینا اختیار منذ 2 شهرًا

مینا اختیار منذ 2 شهرًا إيران

زاوية الصلب والقناة

إيران

زاوية الصلب والقناة

مرحبًا ، نحن ننتج زاوية الصلب والقناة ويمكننا تصدير هذه المنتجات ، لمزيد من الشرح يرجى مراسلتي في wtpالتفاصيل

-

شمش آهن و ميلگرد منذ 2 شهرًا

شمش آهن و ميلگرد منذ 2 شهرًا إيران

تصدير قضبان الحديد والحديد الزهر والألمنيوم واليوريا والكبريت والأسمنت

إيران

تصدير قضبان الحديد والحديد الزهر والألمنيوم واليوريا والكبريت والأسمنت

نحن في مكتب التجارة للتصدير والاستيراد قادرون على توفير قضبان الحديد والحديد الزهر بالإضافة إلى قضبان الألمنيوم والنحاس، وكذلك توفير الأسمنت والمواد ا...التفاصيل

-

سانغاي قیمتی منذ 3 شهرًا

سانغاي قیمتی منذ 3 شهرًا إيران

أحجار كريمة

إيران

أحجار كريمة

مرحبًا أصدقائي الأعزاء، تتوفر عدة عينات من الأحجار الكريمة للبيع، حجر الفيروز الأصلي وحجر الأحفورالتفاصيل

-

حسین منذ 4 شهرًا

حسین منذ 4 شهرًا إيران

Stone

إيران

Stone

بيع جميع أنواع النيازك والأطباق القديمة والعتيقةالتفاصيل

-

إيران الماس منذ 2 شهرًا

إيران الماس منذ 2 شهرًا إيران

أحجار كريمة، ألماس

إيران

أحجار كريمة، ألماس

بضع جرامات من الألماس المتنوع، اليشم، الزمرد، نيزك المريخ، القمر، إلخ. ، الياقوت وحجر الترياق، حجر العلاجالتفاصيل

-

مهندس مهرسام منذ 2 شهرًا

مهندس مهرسام منذ 2 شهرًا إيران

قديم

إيران

قديم

خبرة عالية في مبيعات النقدالتفاصيل

-

عبدالعزیزرودینی منذ 3 شهرًا

عبدالعزیزرودینی منذ 3 شهرًا إيران

النيازك والأحجار الكريمة

إيران

النيازك والأحجار الكريمة

أريد بيع الأحجار التي أملكها، لقد تم تقييمها والموافقة عليها من قبل الخبراء.التفاصيل

-

فريد أحمد منذ 2 شهرًا

فريد أحمد منذ 2 شهرًا إيران

قطع أثرية من أفغانستان

إيران

قطع أثرية من أفغانستان

مرحبًا، يوم سعيد لك. هناك بعض العملات، حمامة واحدة، وملعقتان.التفاصيل

-

بازرگانی مهدی نوری منذ 3 شهرًا

بازرگانی مهدی نوری منذ 3 شهرًا إيران

خردة الحديد، خردة المعادن، الأنابيب والملفات

إيران

خردة الحديد، خردة المعادن، الأنابيب والملفات

تعمل شركة مهدی نوری للتجارة في السلع التالية: حديد التسليح الأنابيب والملفات خردة الحديد الفواكه المجففة التوابل البلاط والسيراميكالتفاصيل

-

مهدي منذ 3 شهرًا

مهدي منذ 3 شهرًا إيران

مواد بناء متنوعة بما في ذلك الأسمنت، الجبس، الكتل، وهيبل. منتجات الحديد المختلفة وحديد التسليح. أسمدة متنوعة، بذور، ومبيدات حشرية.

إيران

مواد بناء متنوعة بما في ذلك الأسمنت، الجبس، الكتل، وهيبل. منتجات الحديد المختلفة وحديد التسليح. أسمدة متنوعة، بذور، ومبيدات حشرية.

أسمدة، بذور، ومبيدات حشرية. مواد بناء متنوعة. منتجات الحديد المختلفة وحديد التسليح.التفاصيل

-

ماسي سامي منذ 5 شهرًا

ماسي سامي منذ 5 شهرًا إيران

شريط و قضيب نحاسي

إيران

شريط و قضيب نحاسي

يمكننا أن نقدم لك شريط و قضيب نحاسي بأفضل جودة وأفضل عرض.التفاصيل

-

بهینبرنز. کو منذ 2 شهرًا

بهینبرنز. کو منذ 2 شهرًا إيران

أنبوب وقضيب نحاسي

إيران

أنبوب وقضيب نحاسي

تصنيع جميع أنواع الأقسام النحاسية. بشكل دائري-سداسي بأقل سعرالتفاصيل

-

حسن منذ 3 شهرًا

حسن منذ 3 شهرًا إيران

نيزك

إيران

نيزك

قطعتان من نيزك بوزن 200 كجمالتفاصيل

-

عادل وجودي فخرنجاد منذ 3 شهرًا

عادل وجودي فخرنجاد منذ 3 شهرًا إيران

زمرد الياقوت النيزكي

إيران

زمرد الياقوت النيزكي

مرحبًا، آمل أن تكون بخير. لدي بعض الياقوت النيزكي والزمرد الذي أريد بيعه. لدي الكثير من أحجار البيض النيزكية. إذا كان بإمكان أي شخص التعاون معي، يمكنن...التفاصيل

-

علي رحماني منذ 3 شهرًا

علي رحماني منذ 3 شهرًا إيران

التحف القديمة

إيران

التحف القديمة

سلعي فريدة وجميلة بشكل استثنائي، من الفترة ما قبل الأخمينية إلى القطع الأثرية والتماثيل الحيوانية المزينة بالفضة والذهب، جميعها مرسومة يدويًا مع النقو...التفاصيل

-

شاهبور منذ 3 شهرًا

شاهبور منذ 3 شهرًا إيران

أحجار كريمة

إيران

أحجار كريمة

ماس خام، ياقوت، عقيق، ونيازكالتفاصيل

-

عبدالحكيم آسي في منذ 2 شهرًا

عبدالحكيم آسي في منذ 2 شهرًا إيران

المكسرات

إيران

المكسرات

يمكن توفير السلع بأي جودةالتفاصيل

-

شركة ثامن الأنوار للصناعات الفلزية منذ 2 شهرًا

شركة ثامن الأنوار للصناعات الفلزية منذ 2 شهرًا إيران

معادن

إيران

معادن

السلام عليكم، أنا السيد حسن حميد رازي من صناعات ثامن الأنوار المعدنية (ثامن فارفورجا). إنها واحدة من أكبر المصانع في إيران لصناعة المعادن والأبواب وال...التفاصيل

-

شيركات شيمي نصر مصاغ منذ 3 شهرًا

شيركات شيمي نصر مصاغ منذ 3 شهرًا إيران

سبائك النحاس الفسفوري

إيران

سبائك النحاس الفسفوري

شيركات شيمي نصر مصاغ أول منتج لسبائك النحاس الفسفوري في إيران تستخدم سبائك النحاس الفسفوري كمواد خام لإزالة الأكسجين والتشحيم في جميع صناعات المعادن غ...التفاصيل

-

إيران

نموذج مجوهرات فضية مذهلة وفريدة من نوعها معالجة أحجار

إيران

نموذج مجوهرات فضية مذهلة وفريدة من نوعها معالجة أحجار

مرحبًا احترامي، أنا مينو باختار، صانع ومصمم مجوهرات فضية لنماذج خاصة، كلاسيكية وعصرية أنا مهتم بالتعاون مع بائع جملة في الولايات المتحدة الأمريكية، ال...التفاصيل

-

جولفا تجارت رحيم أراس منذ 2 شهرًا

جولفا تجارت رحيم أراس منذ 2 شهرًا إيران

أنواع مختلفة من مواد البناء والسلع الجافة

إيران

أنواع مختلفة من مواد البناء والسلع الجافة

تصدير أنواع مختلفة من الفولاذ بأقصر وقت تحميل وتسليم في الوقت المناسب بأقل الأسعارالتفاصيل

-

إبراهيم نوروزيان منذ 3 شهرًا

إبراهيم نوروزيان منذ 3 شهرًا إيران

ألماس، تحف وعتيق، ياقوت، جاد، لازورد، عقيق، أحافير، و.

إيران

ألماس، تحف وعتيق، ياقوت، جاد، لازورد، عقيق، أحافير، و.

أحجار كريمة متنوعة، نيازك، أحجار عقيق، لازورد، ألماس، أحجار الرحى، و.التفاصيل